Wage calculator with overtime

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Texas. Ad Create professional looking paystubs.

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

A RHPR OVTM Overtime pay per.

. 1830 per month 18304 45750 per week Divide the weeks pay by the number of hours worked ex. Hours worked during week. Enter Hours Worked hint - enter decimal 85 or.

The regular rate of pay includes a number of different kinds of. Overtime Number of overtime hours X Per hour salary X 25. Overtime hours worked and pay period both optional.

If you are a monthly-rated employee covered under Part IV of the Employment Act use this calculator to find out your pay for working overtime. All Services Backed by Tax Guarantee. To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above.

The table on this page shows the base pay rates for a GS-12 employee. The employees total pay due including the overtime premium for the workweek can be calculated as follows. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Wisconsin.

This easy and convenient tool will help employers and employees within the state of California to accurately calculate overtime hours worked. All Services Backed by Tax Guarantee. In a few easy steps you can create your own paystubs and have them sent to your email.

This calculator can determine overtime wages as well as calculate the total earnings. Per day Salary8per hour salary. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Florida.

Divide the pay by four work weeks to get their weekly pay ex. Calculate the approximate number of hours that an. Multiply 10 by 10 her first rate to equal 100.

Then multiply 40 by 20 the amount she is compensated at the second rate to. You can claim overtime if you are. Overtime is based on the regular rate of pay which is the compensation you normally earn for the work you perform.

Weekly Paycheck Calculator with Overtime Hourly pay rate hr. Overtime 2After hrs paid at. The calculator below can be used as a rough guide to determine how much overtime to which a California employee might be entitled 2 Please note that this calculator.

The algorithm behind this overtime calculator is based on these formulas. The overtime calculator uses the following formulae. Below you can find a quick explanation of how our overtime calculator works.

We use the most recent and accurate information. The hourly base pay of a Step 1 GS-12 employee is 3273 per hour 1. Regular Pay per Period RP Regular Hourly Pay Rate Standard Work Week Overtime Pay Rate OTR Regular Hourly Pay Rate.

All inclusive payroll processing services for small businesses. How to use the overtime calculator Input the employees annual salary. 1200 40 hours 30 regular rate of pay 30 x 15 45 overtime.

Get a free quote today. Quickly determine fair compensation for 7000 jobs 1000 industries. Ad Set pay with trusted wage survey data.

Daily results based on a 5-day week Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the. Regular Time From 0 to hrs paid at. To calculate pay with locality adjustments.

Enter the number of paid weeks the employee works per year. The calculator works out the employee weekly pay and working hours and. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in New York.

This calculator can determine overtime wages as well as calculate the total. This calculator can determine overtime wages as well as calculate the total earnings. Get a free quote today.

Overtime 1After hrs paid at. This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. In the Weekly hours field.

All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. Basic Salary X 12365 per day salary. Calculation of overtime is very easy and is.

Free demo for HR professionals. This calculator can determine overtime wages as well as calculate the total. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Enter your normal houlry rate how many hours hou work each pay period your overtime multiplier overtime hours worked and tax rate to figure out what your overtime hourly. Ad Payroll So Easy You Can Set It Up Run It Yourself. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

We calculate Tanias overtime pay as follows. How to calculate overtime pay. Ad Accurate Payroll With Personalized Customer Service.

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

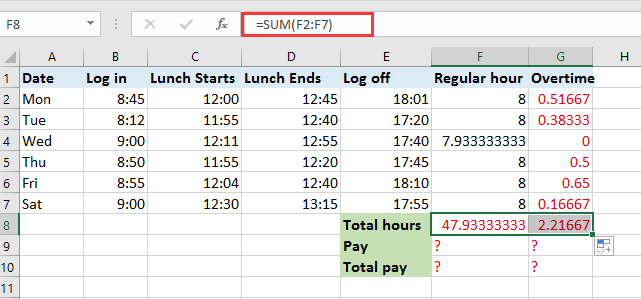

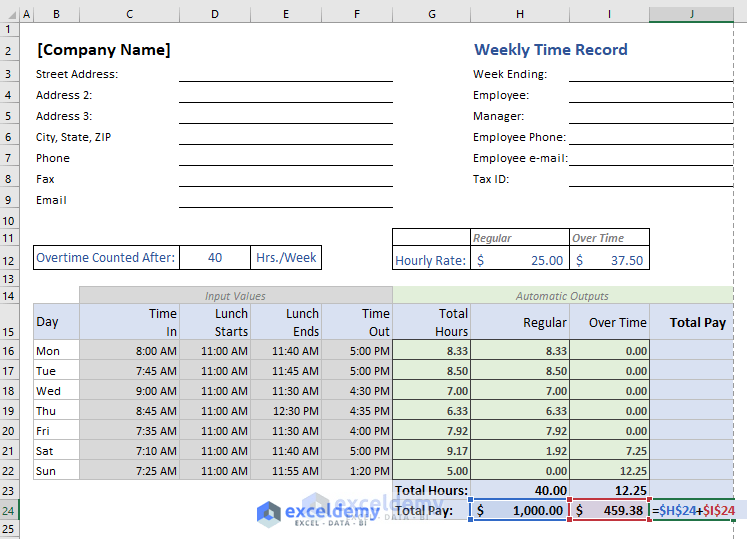

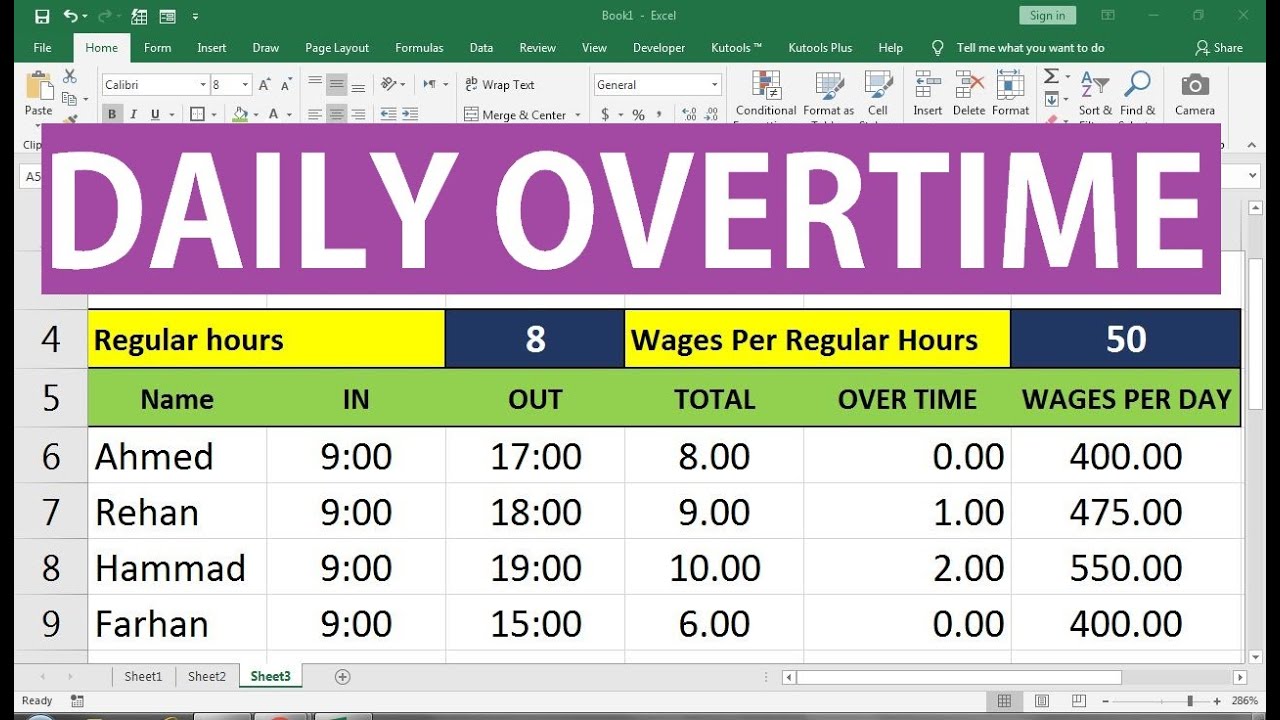

How To Quickly Calculate The Overtime And Payment In Excel

Excel Formula To Calculate Hours Worked Overtime With Template

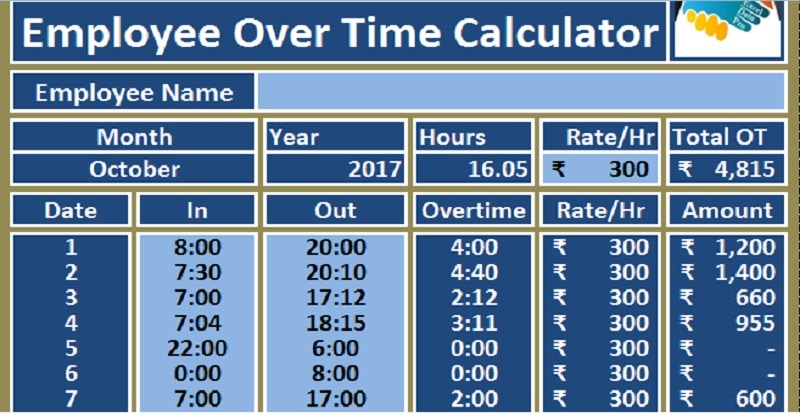

Download Employee Overtime Calculator Excel Template Exceldatapro

Overtime Calculator

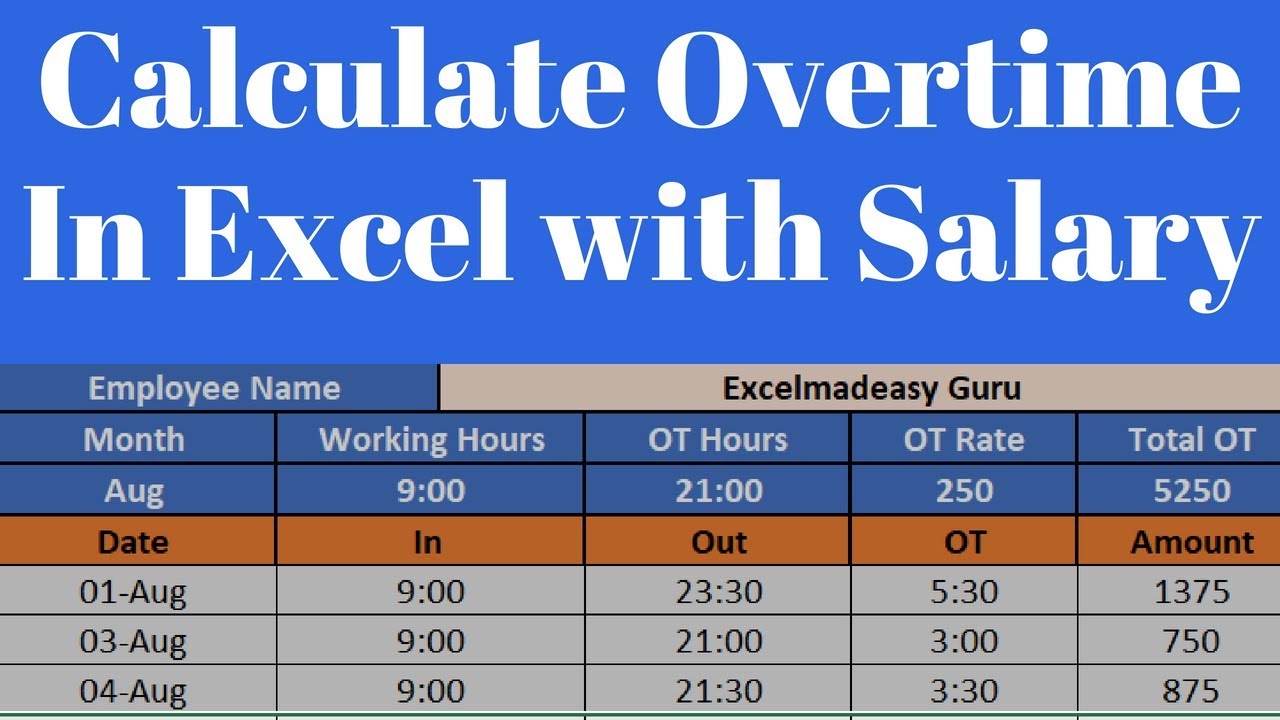

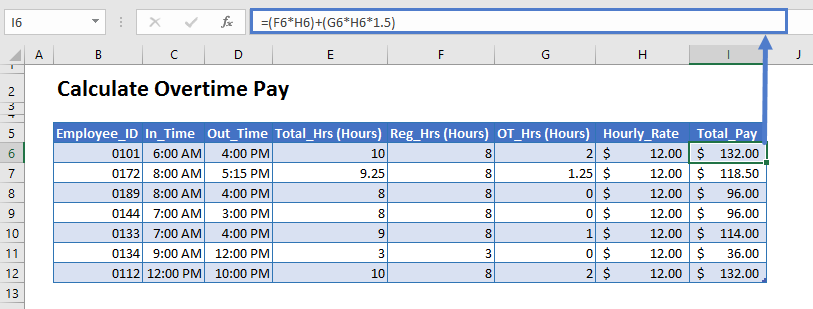

Calculate Overtime In Excel Google Sheets Automate Excel

Tom S Tutorials For Excel Calculating Salary Overtime Tom Urtis

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Overtime Calculator Clicktime

How To Calculate Overtime In Excel In Hindi Youtube

How To Quickly Calculate The Overtime And Payment In Excel

Excel Formula Basic Overtime Calculation Formula

Overtime Calculation Formula In Excel Youtube

Overtime Pay Calculators

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Pay Calculators

Excel Formula Timesheet Overtime Calculation Formula Exceljet