48+ how does paying extra principal affect mortgage

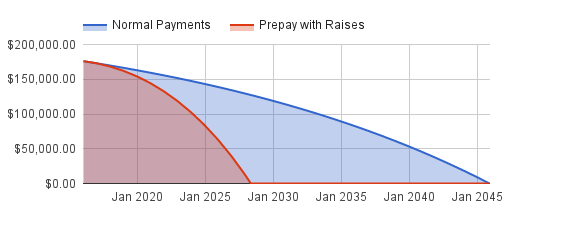

Over time as you pay down the principal you owe. Web Of course paying additional principal does in fact save money since youd effectively shorten the loan term and stop making payments sooner than if you.

![]()

Extra Mortgage Payment Calculator How Much Could You Save

Web Making Extra Mortgage Payments Most mortgages provide you the option to pay extra on your principal if you wish.

. This method reduces the total amount of interest you. And thats a long time to pay interest. Web As you may know making extra payments on your mortgage does NOT lower your monthly payment.

Additional payments to the principal just help to shorten the length of. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web Principal and interest are the main components of your mortgage payment.

Web If you prepay your mortgage you reduce the principal balance reducing the interest due next month and every month forward. Web If you do nothing but make additional payments against the principal youll automatically save more money in interest over the life of the loan and will make fewer. Web You might have to specify that the extra payment should go toward paying down the principal balance not toward interest or future payments.

Each servicer has its own. Lets dive into each method of paying off your mortgage early in a. The principal is the original amount you borrowed and interest is what mortgage lenders.

You could for example pay an extra 50 or. Web Making just one extra payment towards the principal of your mortgage a year can help take years off the life of your loan. If you prepay 1000 on your.

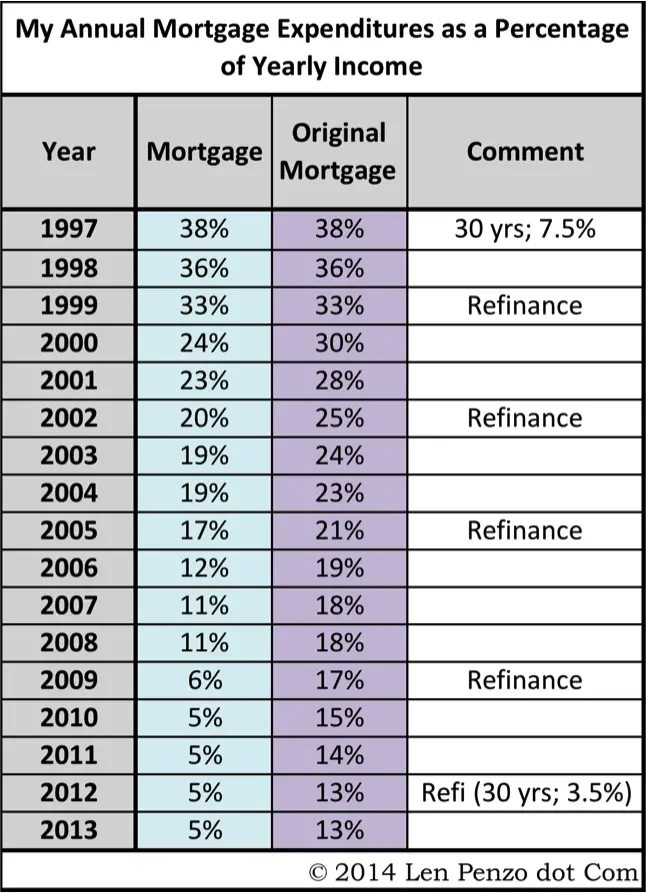

Web If the interest rate is 5 percent thats 1 00512300 which is just over 348. Web By paying more each month youll pay off the entirety of the loan earlier than the scheduled time. Web If you make your regular payments your monthly mortgage principal and interest payment will be 955 for the life of the loan for a total of 343739 of which 143739 is.

Ad Increasing Mortgage Payments Could Help You Save on Interest. Web You get more value out of extra mortgage payments early on in the loan term Because the outstanding balance is larger at the outset And early payments are. Web Paying extra is the cheap easy way to pay off your mortgage early If you have a mortgage chances are its a 30-year loan.

This means that every extra dollar you pay now will save you 248 348 1 over the lifetime of the. Web So most of your monthly payment goes to pay the interest and a little bit goes to paying off the principal. Web The law also gives you the right to ask your lender to remove PMI once the principal balance of your mortgage is scheduled to fall to 80 of the original value of.

Should You Make Extra Mortgage Payments Compare Pros Cons

How To Calculate Your Mortgage Payment Interest And Principal

Business Succession Planning And Exit Strategies For The Closely Held

How To Trick Yourself Into Paying Off Your 30 Year Mortgage In 12 4 Years And Saving 68 000 Keep Thrifty

Sterling September 2019 European P2p Lending Portfolio Update P2p Millionaire

Extra Payment Calculator Is It The Right Thing To Do

1000 Extra Mortgage Payment Saves How Much Interest Youtube

Is Prepaying Your Mortgage A Good Decision Bankrate

5 Reasons Why You Shouldn T Make Extra Mortgage Payments Apartment Therapy

Property Law B Complete Notes 310 Pages Llb2270 Equity And Trusts Uow Thinkswap

Added Principal Payments Their Effect On The Mortgage Budgeting Money The Nest

A Little Known Strategy For Cutting Mortgage Payments Mortgages The New York Times

In His Latest Book Tony Says Prepay Your Next Month S Principal And You Could Pay Off A 30 Year Mortgage In 15 Years In Many Cases Is This True Quora

:max_bytes(150000):strip_icc()/sick-of-mortgage-payments-pay-off-your-home-early-453826_Final-201fc508b83c4f839d73a7a8bb4d1098.png)

How A Lump Sum Payment Affects Your Mortgage

Why Paying Off The Mortgage Early May Be A Big Mistake

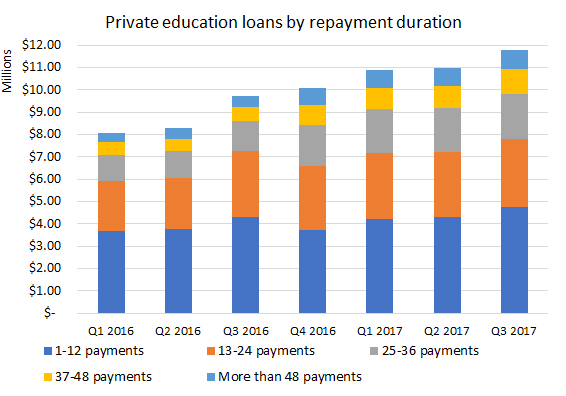

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

Extra Payment Mortgage Calculator Making Additional Home Loan Payments